YOUR ACCOMMODATION AND FINANCES

Living away from home or moving out of university halls means you'll have new responsibilities with your money that you probably haven't had to think about in the past. Accommodation and paying the bills will be some of your largest expenses. Here are some costs to think about and some tips on saving money in your student home.

RENT

The rental prices for student accommodation vary according to the location, type of property, facilities and the standard of property.

An ensuite room located in the City Centre ranges from £118 to £165 PPPW all-inclusive depending on size, room type, location, facilities etc

If you are planning to share a house with your friends, you should decide between you what you can afford to pay for rent, having factored in all other household and living expenses.

ENERGY EFFICIENCY

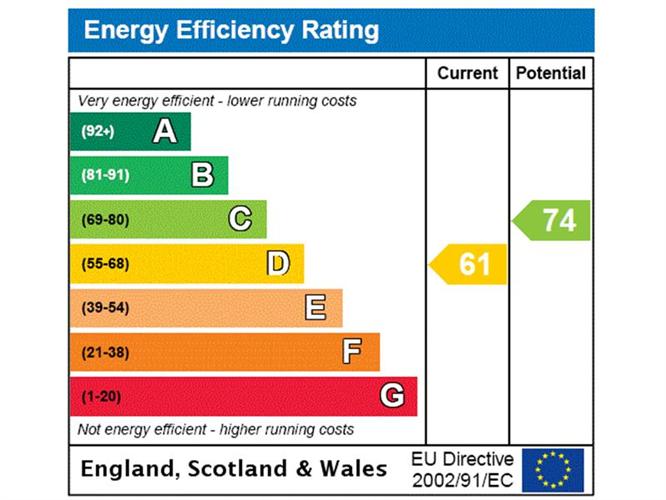

All domestic and commercial buildings in the UK available to buy or rent must have an Energy Performance Certificate (EPC).

EPCs tell you how energy efficient a property is and give it a rating from A (very efficient) to G (inefficient). They let you know how costly the property will be to heat and light, and what its carbon dioxide emissions are likely to be. From April 2018, landlords of privately rented domestic and non-domestic property in England or Wales must ensure that their properties reach at least an Energy Performance Certificate (EPC) rating of E before granting a new tenancy to new or existing tenants.

METER READINGS

It’s important to take regular meter readings and give them to the energy supplier and landlord, to prevent bills from being estimated.

Quite often energy companies will over-estimate how much fuel you have used, so you may end up paying more than you need to.

It’s particularly important to read the meters on the day you move in and when you move out. Give these to the landlord and energy suppliers to ensure you’re not paying for the previous tenants’ bill.

SMART METERS

Smart meters are the new generation of electricity and gas meters being rolled out across Great Britain. They let you know how much energy you are using in near real-time so you can see exactly how much you are spending on energy (rather than waiting months for your first energy bill, as used to be the case). Once you have a smart meter you can get your energy bills under control by using the in-home display that comes with the smart meter to identify what in your house is using loads of energy!

Smart meters are available at no additional cost but you should discuss having one installed with your landlord or agent before you go ahead. The time it takes to get one installed will depend on where you live and which energy company you are with.

Check out the video

here which provides information on the benefit of smart meters to students and also look at the Smart Energy GB website

here which has loads of information on when each of the energy companies are rolling out smart meters.

HOUSEHOLD BUDGETING

Getting the household expenses organised at the beginning will save a lot of stress later on. It’s a good idea to draw up a budget of estimated household expenses so you can be prepared for when payments are due and so you know what you have left to spend on other stuff.

How much to budget for gas and electricity?

The cost will depend on a variety of factors but as an estimate we recommend that you budget around ............ per person per week. Also, check the Energy Performance Certificate (EPC) for the property.

All-inclusive rents

If your bills are included in the rent payment, you may want to check your contract to see if there is a cap or limit on your fuel consumption. If your consumption goes over this cap, you will be required to pay the extra cost. It’s also best to get a copy of the bill to check that the energy consumption is correct and based on actual meter readings and not estimated.

Water and internet

Usually the cost of water supply is included in your rent. Internet may or may not be. Ask the landlord how internet is supplied in the property and how the bill is to be paid.

TV Licence

This is required if you watch live TV, regardless of which device you use. It is £159 per year but you can get a refund for the summer months if you move out of your term-time address. See TV Licensing.

Contents insurance

Check if you are covered on your parent’s or landlord’s policy. If not, it’s important you take out your own, to cover your belongings. Some companies specialise in student contents insurance.

Food

You may want to discuss with your housemates how to organise the food shop, the cheaper option is to do a regular supermarket shop.

Travel

If you are not living in the City Centre, you need to consider your transport costs both for getting to university and also for socialising.

MONEY-SAVING TIPS